Liquid Vaults

Interoperable native DApp optimising ecosystem capital efficiency via unlocking utility of yield bearing assets

Why

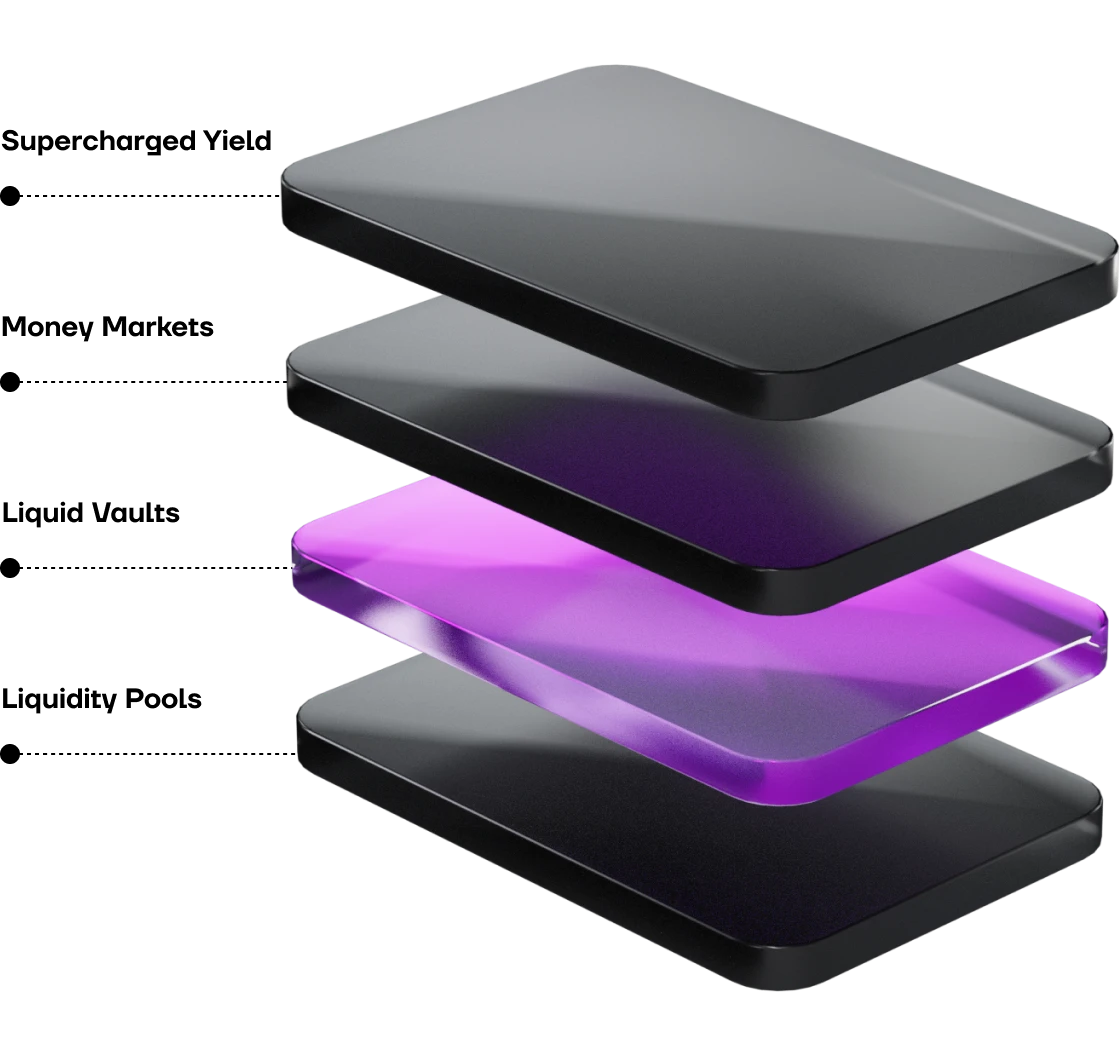

Liquid Vaults change the DeFi landscape by optimizing liquidity across multiple chains.

In a fragmented DeFi ecosystem, where DEX, Lending, and Derivative protocols operate in isolation, Liquid Vaults expands capital efficiency and empowers a new spectrum of DeFi strategies.

Refinancing of Yield Assets

Obtain Higher Yields via Asset Composability

Composable Derivative Tokens

How

Liquid Vaults allow users to auto-stake LP tokens and in return, receive a 1:1 backed Composable Derivative Tokens (CDTs), reflecting the staked value of the underlying LPs.

Liquid Vaults automatically stake and auto-compound the LP Token in the designated yield farm, generating increased yields for users.

CDTs are minted on the native blockchain of the LP token with no custody of the collateral by Entangle.

To enhance capital efficiency of liquidity and yield generation, users can now borrow against CDTs via Money Market Protocols in partnership with Entangle or utilize for other forms of DeFi.

Step 1

Stake

Stake LP Token via Liquid Vaults to receive CDTs

Step 2

Borrow

Borrow liquidity against CDTs

Step 3

Supercharge

Supercharge your yield